💸 1. Make Money Work For You: While most people trade time for money, the rich let their money work for them through business and investing

The biggest lesson from “Rich Dad Poor Dad” is that while most people trade time for money, wealthy people make their money work for them. How? through smart investing and entrepreneurship. And that’s what this book is all about.

As a kid, Robert Kiyosaki and his friend Mike were teased for not being rich, so they came up with a wild plan to “make money.” They collected metal toothpaste tubes, melted them down, and began making coins. They were “making money,” literally.

Robert’s dad caught them, he was shocked and quickly pointed out what they were doing was dangerous and illegal. Then he suggested that if they wanted to make money, they should talk to Mike’s dad, who was actually a successful businessman. Mike’s dad agreed to teach the boys, making him Robert Kiyosaki’s “Rich Dad.”

Learning from “Rich Dad”

The boys were excited to learn how to get rich. But their first assignment was incredibly boring. “Rich Dad” sent them to work at one of his convenience stores for 10 cents an hour on the weekends, cleaning the cans on the shelves.

Even in those days, that was little money. So after four weeks, Robert wanted to quit in frustration. And “Rich Dad” hadn’t really taught them anything yet. So he confronted “Rich Dad,” accusing him of ripping off kids.

“Rich Dad” calmly explained that he was teaching the kids, not through a lecture, but through real life experiences. That is the same way life teaches us, it pushes us around, forcing us to learn and adapt.

Working hard vs spotting opportunity

The first important lesson Robert learned in that store was how hard most people work for so little money. Right away, he knew he didn’t want to do that all his life. On its own, that was a very valuable lesson and motivator.

Rich Dad taught Robert and Mike to control their emotions around money, explaining that most people are driven by fear and greed, which keeps them stuck “working hard” but getting nowhere financially.

While most people trade their time for money, rich people look for ways to make their money generate more income for them, even when they aren’t working.

Instead, we need to learn how to spot opportunities, which are all around us, but invisible to most people. The boys took this lesson and soon noticed one such opportunity.

At the convenience store, the manager would throw away unsold comic books. They asked if they could keep the books, and the manager said yes, but they couldn’t resell them. So the boys opened up a comic book library in their basement, charging the kids in the neighbourhood a little money to read as many comics as they wanted.

They were soon making way more money from this library than their jobs, learning an invaluable lesson about money and passive income. (Later you’ll see how Kiyosaki applied this to spotting real estate opportunities.)

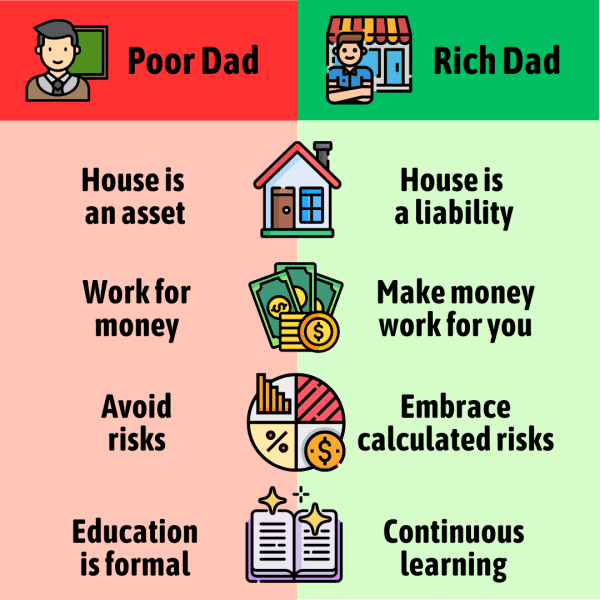

Rich Dad vs Poor Dad

Robert Kiyosaki was fortunate to have two father figures with very different views on money. His biological father, whom he calls “Poor Dad,” was a teacher who believed in getting a good education and working your way up the career ladder. Job security and benefits were his top priorities.

By contrast, his “Rich Dad,” the father of his best friend, believed more in self-education and the importance of making money work for you.

- Most people trade time for money, while rich people make their money work for them, through business and investing. This is less about working hard, and more about financial literacy and spotting opportunity.

- “Rich Dad” was the father of Robert Kiyosaki’s best friend Mike. He was a successful entrepreneur and agreed to teach the boys about how to make money.

A more recent bestselling finance book is “The Psychology of Money” by Morgan Housel. In that book, he explains how the richest investors, like Warren Buffett, think.

He discovered that successful investing is less about fancy financial math and more about remaining in control of your emotions during market downturns. A great quote: “Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

🏠 2. Assets vs. Liabilities: The key to wealth is understanding the difference between income-generating assets and cash-sucking liabilities

Most people think that a higher income would solve all their money problems. But “Rich Dad Poor Dad” argues that real wealth is about passive income. And to make passive income, you must understand assets versus liabilities.

Here’s why a high income is not the solution. If we look at high-income professionals like doctors and lawyers, they fall into the same trap as the rest of us. As their income grows, so do their expenses. They buy bigger houses and nicer cars, but they’re still stuck trading time for money just to maintain their lifestyle.

Even lottery winners and professional athletes often go broke a few years after landing millions. Why? Because for most people, more money usually means more spending and more debt, not more financial security.

“The Millionaire Next Door” is another great finance book that studied what millionaires really look like. Most people think a millionaire drives a flashy sports car and lives in a huge mansion, but they found your typical millionaire is usually a blue-collar business owner who lives next door and drives a regular Toyota or Ford.

The book makes an important point: being wealthy isn’t about how much money you make each year, it’s about how much money you keep. Those authors said, “Wealth is not the same as income. If you make a good income each year and spend it all, you are not getting wealthier. You are just living high. Wealth is what you accumulate, not what you spend.”

Truly wealthy people are playing a different game altogether. A game that allows them to not work at all and still have money coming in. Here’s the secret to how they do it…

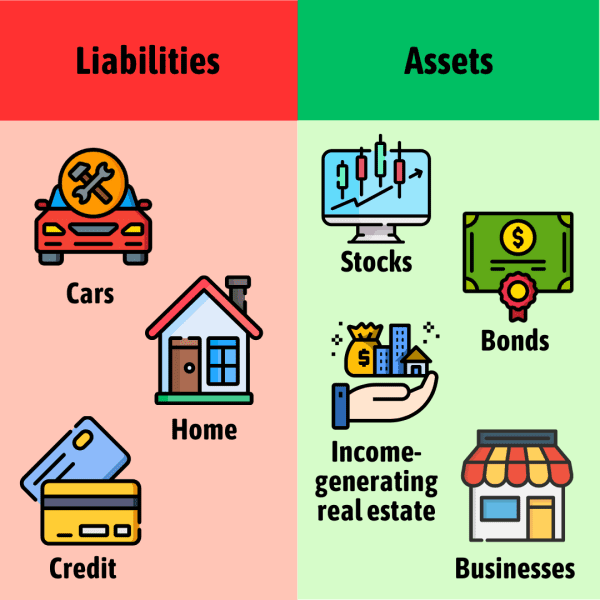

Understanding assets and liabilities

Rich people use their money to buy assets. What are assets? They include stocks, bonds, and real estate. An asset is anything that generates income for you, even when you’re not working.

Kiyosaki uses the example of Ray Kroc, who grew McDonald’s into a global brand. Kroc often said his real business was not selling hamburgers, but owning the real estate beneath each restaurant.

Poor and middle class people, on the other hand, tend to buy liabilities. What is a liability? Anything that drains money, like a nice car, credit card debt, and even your house.

A house is not an asset?!

Saying that a house is not an asset is one of Kiyosaki’s more controversial statements. He argues that since your house doesn’t generate income, and requires money to maintain, it doesn’t fit his definition of an asset.

Kiyosaki says it’s important to question common financial advice and think critically about what we’re usually told about money. Most people don’t do this, so they end up following the crowd because it feels safest.

Start acquiring assets ASAP

So how do we get started? Surprisingly, Kiyosaki recommends NOT starting your own business, because entrepreneurship is a risky path that is not for most people.

Instead, he recommends using your regular income to begin acquiring assets. He began building wealth while working in the Marines and as a copy machine salesperson, and built enough passive income to be able to retire at 47. To make this work, you’ll need to reduce your expenses, avoid buying liabilities, and put that money towards buying assets.

What if you want to buy something nice?

Avoid buying unnecessary things with your paycheck—that’s a money habit that prevents many people from building wealth.

Instead, use your paycheck to buy assets that generate income for you, then use your asset income to buy the things you want. For example, after a few years of real estate investing, Kiyosaki used his passive income to pay for a Porsche.

- Rich people get richer by buying assets—things like stocks, real estate, and bonds that make money for them.

- Poor and middle-class people often end up poorer by spending on liabilities—things like cars and credit card debt that drain money.

- To start building wealth, cut down on expenses and invest in assets as soon as you can.

The Richest Man in Babylon is a classic book on money that teaches key principles of financial literacy through short parables set in an ancient desert. In it, you learn how to live on less than you earn, think critically about financial advice you hear, and “learn to make gold work for you.”

This is the book that popularized the expression “pay yourself first,” which means to first set aside some money from each paycheck for your savings, before paying your other expenses. So if you want a solid foundation in personal finance, it’s worth reading!

🛠️ 3. Don’t Work (Just) For Money: Choose jobs that help you level up your skills and acquire valuable knowledge, not just a good paycheck

Imagine you were offered two jobs. One job pays well and is comfortable. The other job pays a little less, but would teach you valuable skills. Which job would you choose? Most people would automatically go for the higher-paying job, but this book says that is a mistake.

Choose jobs that challenge you

Rich Dad believed we should choose the job that challenges us to learn new, valuable skills, because real-world experience is usually the best teacher. He also said it’s good to know a little about many things. The education system pushes us to specialize, but that makes us more vulnerable to market changes.

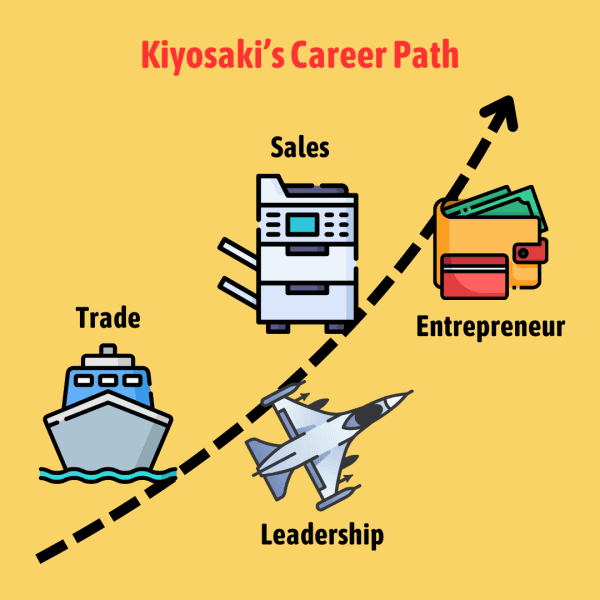

Robert Kiyosaki took that advice to heart:

- Kiyosaki’s career began at Standard Oil, on a large ship where he learned about international trade.

- Then he joined the Marines to develop his leadership skills.

- After that, he suddenly quit and took a sales job at Xerox, selling photocopy machines. He overcame his natural shyness to become one of their top salespeople.

His “poor dad” was surprised and confused by these moves—why would he quit good career paths to do something totally different? But Kiyosaki knew the important thing was not just job security, but continuing to grow. All the skills he learned were invaluable in his later businesses.

The most important skills are sales and marketing

No matter what you do, you’ll need to sell something, whether it’s a product, service, or an idea. The most important skills to learn are sales and marketing because they let you communicate effectively and overcome rejection.

One time, a writer was interviewing Robert Kiyosaki, who is a best-selling author, and she asked him how to improve her book sales. He told her to take a sales course. She got offended, feeling that sales was somehow dirty and beneath her.

Kiyosaki pointed out with a smile that he was a “best-selling author,” not a “best-writing author.” He wasn’t the best writer, but he was a great salesman of his books. For example, his first book was “If you want to be rich and happy, don’t go to school?”—a somewhat obnoxious title that got people talking, and that got attention, interest, and lots of sales.

(Kiyosaki is not actually against education, but he knew the title his editor recommended—”The Economics of Education”—would have sold approximately zero copies.)

- Many people view work only as a means to earn money, but it’s also the best way to acquire important skills and knowledge.

- Kiyosaki worked on a ship to learn trade, then the Marines to learn leadership, then at Xerox to learn sales. All these skills eventually proved useful as an entrepreneur.

Arnold Schwarzenegger echoes this advice in his autobiography, where he says sales and promotion were the key to his success in bodybuilding, movies, and politics.

He defines selling as simply making people aware of what you’ve made. You can have the best product or the best movie, but if nobody goes to see it, then it doesn’t make an impact.

🏦 4. Spotting Real Estate Opportunities: How Kiyosaki turned $20,000 into $190,000 by identifying unique investing opportunities

There are two types of investors, says Kiyosaki. The first type buys pre-packed investments, like mutual funds, which are pretty safe but grow money slowly. The second type creates their own investments, which offers larger gains but also greater risks.

Robert Kiyosaki’s investing strategy

Kiyosaki mostly invests in real estate because it’s relatively stable.

He also puts a smaller portion of his money into companies about to launch publicly (like startups). This is riskier—sometimes he loses money, but sometimes he make a huge profit if the company takes off. Why is the risk worth it? Because there’s always a chance he might hit a “grand slam,” by investing early in the next Facebook.

Speaking of which, the first actual investor in Facebook was Peter Thiel, who is now a billionaire. In his book Zero to One, Peter Thiel says “the biggest secret” of startup investing is that almost all of the most successful investors have made more money from their ONE best investment, than from all their other ones… combined. For his fund, that exceptional company was Facebook.

In other words, a venture capital investor only needs to be right one time to become incredibly wealthy.

Turning $20,000 into $190,000+

Kiyosaki tells a real-life story to illustrate how to spot unique real estate investing opportunities. Many years ago, there was a market downturn in Phoenix, so he began looking for a home in that city. He found a foreclosed home worth $60,000 that he bought for $20,000.

How did he get such good price? Kiyosaki makes a lot of offers, expecting most to be rejected. (With each offer he adds an “escape clause” in case he doesn’t want the deal, saying “contingent on the approval of my partner,” but the partner is secretly his cat.)

Anyway, the Phoenix market bounced back and he sold the house for $70,000 by running a newspaper ad. This gave him a $40,000 promissory note which paid 10% interest, or $4,000 per year in passive income.

Then he repeated this process six more times, ending up with $190,000 in assets, that earned him $19,000 per year in interest. And let’s keep in mind this book was first published over 25 years ago so these numbers would be much larger today.

The importance of financial knowledge

This story illustrates that it is possible to get a much higher return by thinking creatively about how we invest. Kiyosaki found unique opportunities through doing the opposite of most people—buying a home in an area where prices were falling.

But most people go wrong by investing without proper education and experienced advisors, leading to costly mistakes.

Kiyosaki recommends investing heavily in your financial knowledge. For example, early in his career, he bought a real estate course that cost $385. This course taught him how to buy property for no money down, a skill that eventually made him millions.

According to him, there are four key skills for financial intelligence:

- Accounting: Understanding and reading financial statements.

- Investing: Buying assets to make money work for you.

- Market Understanding: Knowing supply and demand to decide when to invest.

- The Law: Using corporations to accelerate your wealth building.

- We can go for safe pre-packaged investments that grow wealth slower, or we can look for unique opportunities. Either way, it’s crucial to gain financial knowledge and advisors.

- Kiyosaki turned a $20,000 investment into a significant income by buying undervalued real estate and selling it when the market improved. He went into a declining area and made tons of offers.

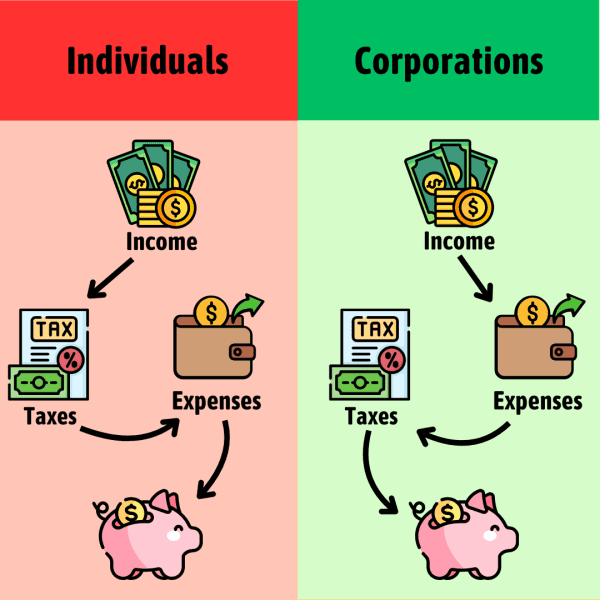

🏢 5. Tax Laws and Corporations: How to minimize taxes and protect your wealth using corporate structures, just like the rich do

Rich Dad doesn’t like taxes. He gave young Robert Kiyosaki a short history of taxes. When taxes are first introduced, they primarily target the wealthy. Over time, as government spending increases, taxes expand to include the middle class.

Then the rich find ways to reduce their tax burden legally, so they end up being less impacted.

In fact, governments wants to incentivize business owners and investors to create more jobs and housing, so they create these beneficial tax laws that are often called “loopholes.” And who ends up paying the most? Highly paid professionals, like doctors and lawyers.

Corporations offer tax benefits and protection

Corporations provide benefits that can help you grow wealth faster.

Most people must pay their taxes first, then their expenses. But a corporation can deduct expenses first, then only pay taxes on the remaining income. This allows you to reinvest more of your money into growing your assets faster. (However, in some cases, corporations can lead to double taxation, where you actually pay more.)

You can also protect your assets better through a corporation. If someone sues you, then your personal assets are safe, like your home.

This author recommends Garrett Sutton’s books to learn more about setting up your own personal corporations.

The Section 1031 Strategy

Kiyosaki spends a lot of time explaining how he uses Section 1031 of the U.S. Tax Code to grow his real estate portfolio way faster.

In the U.S., you can use a 1031 tax-deferred exchange to sell a property, then reinvest the money into a new property, without paying capital gains tax on the sale. Basically, you can keep deferring capital gains tax by continually “trading up” to a larger property. And that makes it much easier to grow your real estate assets.

For example, in 1989 Kiyosaki bought a small house in Portland for $45,000, with a down payment of $5,000. He rented it out for a year, then sold it for $95,000, moving the profit into a 1031 exchange. This allowed him to afford a larger 12-unit apartment building. A few years later, he did it again, trading up to a 30-unit building in Phoenix. He eventually sold that one for $1.2 million.

- Corporations offer significant tax benefits, allowing expenses to be deducted before taxes. They also shield your personal assets from lawsuits.

- Strategies like the 1031 tax-deferred exchange in real estate allow you to grow your portfolio of assets faster by deferring capital gains taxes.

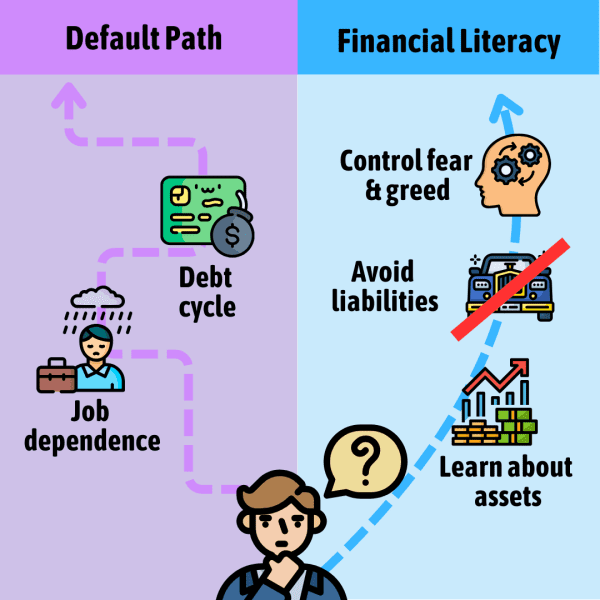

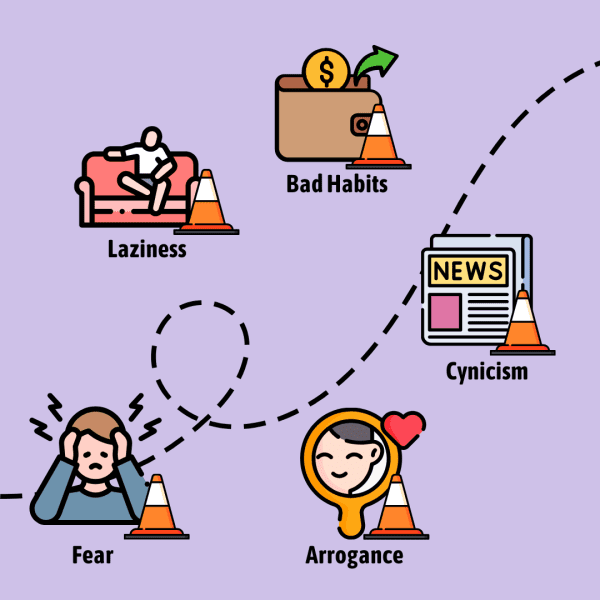

✋ 6. The Five Wealth Blockers: Here’s how to develop a mindset that helps you manage fear, overcome procrastination, and break bad habits

Have you ever known what you needed to do, but you couldn’t make yourself do it? We all have internal blocks that hold us back from becoming wealthy. Robert Kiyosaki discusses a few of these and how to overcome them.

Managing Fear

Most people are afraid to lose money investing. Now, while nobody likes to lose money, the reality is that even the best investors face losses sometimes, including Warren Buffett.

Successful investors understand that some failure is a natural part of the investing process.

Overcoming Cynicism

Stop listening to critics that only have negative opinions. We should understand that news outlets often amplify fear because it captures more attention.

For example, the most successful investors tend to buy when everyone else is scared and selling. During a market downturn, property and stock prices drop. This creates a prime buying opportunity for investors who view the situation more as a temporary opportunity than a permanent catastrophe.

Kiyosaki believes that in real estate, you make a profit based more on the price you buy at than the price you sell at. His strategy relies heavily on looking for great deals, especially during market crashes and corrections. When looking for properties, Kiyosaki often researches the area in-person by jogging or driving through for a year, looking for positive signs of upward growth, like new retailers moving into the area.

Combating Laziness

Laziness is another hurdle. The cure for laziness, according to Kiyosaki, is a little greed. Instead of saying, “I can’t afford it,” ask, “How can I afford it?” This question sparks your creativity and motivation.

Think and Grow Rich by Napoleon Hill is a classic self-help book that continues to be very popular. That author studied 500 millionaires to discover common patterns in their mindset that made them wealthy. He found that rich people harness a burning desire for wealth and persist beyond failure.

Here’s a great quote: “Wishing will not bring riches. But desiring riches with a state of mind that becomes an obsession, then planning definite ways and means to acquire riches, and backing those plans with persistence which does not recognise failure, will bring riches.”

Breaking Bad Habits

The most important habit for wealth building is investing in assets. What stops people from doing it? One significant barrier is consumer debt. High debt levels make it difficult to save and invest. So, by keeping our expenses low and avoiding unnecessary debt, we can begin to afford to buy assets.

Over time, the income from these assets will be able to fund a nicer lifestyle for you and provide financial freedom. (Note: a great book related to this is “The Total Money Makeover” by Dave Ramsey, which teaches the snowball method for getting out of debt.)

Rich Dad and Robert Kiyosaki both follow the practice of “paying yourself first.” This means they invest a predefined amount of money into assets, before paying their bills. Now, this is controversial. Most financial advisors and accountant would say to pay your bills and creditors first. But for Rich Dad, this creates pressure, forcing him to find new ways to generate income, just like physical pressure at the gym makes someone stronger.

Avoiding Arrogance

Arrogance is the mindset that what you don’t know doesn’t matter. Rich Dad said arrogance always cost him money. It’s crucial to stay humble and continuously seek new knowledge and opinions, even if it conflicts with what we already know. Always learn from books and consult experts when you don’t know enough about a subject. Investing without taking time for financial education often leads to costly mistakes.

- We must control our mindset to get rich. We manage fear by understanding that some failure is part of the process of investing. Overcome cynicism by understanding that market downturns contain the largest opportunities.

- Combat laziness with a little greed, asking “How can I afford what I want?” Break the bad habit of not saving by “paying yourself first.” And avoid arrogance by investing in your financial education.

📜 7. Rich Dad’s Best Advice: Eight habits successful people do every day that may change your life

The last part of “Rich Dad Poor Dad” shares a variety of tips related to money, investing, and life. Let’s run through the key points:

Clarify your goals

Write down what you want and don’t want in your life. Your reasons must be strong because the journey won’t be easy.

Invest in your education

Learn about stocks and real estate before investing in them. Most people will not do this. For example, Kiyosaki learned how to buy at foreclosure auctions while working at Xerox, a skill that has made him millions.

(Note: A great place to start is “The Little Book of Common Sense Investing” by John Bogle, a book on investing from the founder of Vanguard, which runs the largest mutual funds in the world.)

Talk to successful people

We can look at rich people to learn what to do when it comes to money, and look at unsuccessful people to learn what not to do. For example, one time in the tax office Kiyosaki met a woman who invested in tax lien certificates, something he didn’t know about. He invited her to lunch and she was more than happy to talk about it.

Pay yourself first

Put money into assets first. When buying a luxury, don’t spend your paycheck income or use consumer debt, but only use the passive income from your assets. This incentivizes further saving.

Pay advisors well

Don’t be cheap with advisors, because good ones should be making you more money than they cost. Kiyosaki recommends you make sure they themselves invest in stocks or real estate.

Ask how long

When you’re thinking of investing in a real estate opportunity, you must ask this critical question: How long will it take to get my money back?

Think like a rich person

When you’re considering whether to invest, it can be helpful to ask: What would a successful investor do in this situation? Whether it’s Warren Buffett, George Soros, or Donald Trump.

To receive, first give

This is like a law of nature. Whatever it is you need, whether money or a smile. First give it, and then you’re more likely to receive it. Give to a charity. Smile at a random stranger.

- To be successful, try these tips: write down your goals; learn from successful people through conversations and books; save first, then spend your investment earnings on luxuries; pay your advisors well; ask how quickly you can recoup investments; think like a successful investor; and give before expecting to receive.

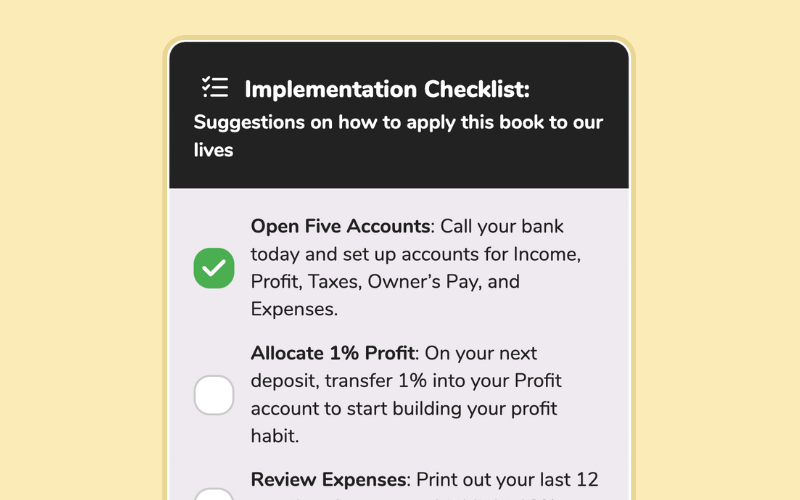

- Set Specific Financial Goals: Write down clear, achievable financial goals for both the short and long term. For example, saving for a down payment on a rental property within the next three years or investing in stocks or mutual funds monthly.

- Educate Yourself Financially: Invest time each week to learn more about finance and investing. This could involve reading books, attending workshops, or taking online courses about real estate, stocks, or other investment opportunities.

- Open an Investment Account: If you don’t already have one, open an investment account to start building your portfolio. Start with safer investments like mutual funds or bonds, and gradually move to more direct investments like stocks or real estate as your knowledge and confidence grow.

- Meet with Financial Advisors: Schedule appointments with financial advisors to discuss your goals and get advice tailored to your financial situation. This step is vital to avoid costly mistakes and ensure that your investment strategies align with your overall financial plan.

- Regularly Review Your Assets and Liabilities: Every quarter, review your financial statements and identify your assets and liabilities. Focus on increasing assets that generate passive income and reducing liabilities that drain your resources.

- Practice Mindful Spending: Adopt a habit of questioning every significant purchase. Ask yourself if it’s an asset or a liability, and how it fits into your broader financial goals.

- Network with Other Investors: Build a network of like-minded investors who can offer support, advice, and potential partnership opportunities. Join real estate or investment clubs to connect with others who can provide insights and experiences.

What's the main way we can "make money work for us"?

By working extra hours

By investing in assets

By saving in a bank

By spending on luxury

What is a key reason for many people's financial struggles, according to Kiyosaki?

Lack of financial education

Lack of job opportunities

Lack of adequate income

Lack of self-discipline

What is the most important way the rich manage their money differently than the poor and middle-class?

Avoid spending money

Work harder than most

Start a profitable business

Invest to generate income

According to Kiyosaki, what are the most important skills to acquire?

Financial planning and accounting

Sales and marketing

Leadership and management

Engineering and technology

Why do the rich use corporations according to Kiyosaki?

Eliminate all taxes

Increase personal spending

Avoid paying expenses

Reduce and defer taxes

Cool!