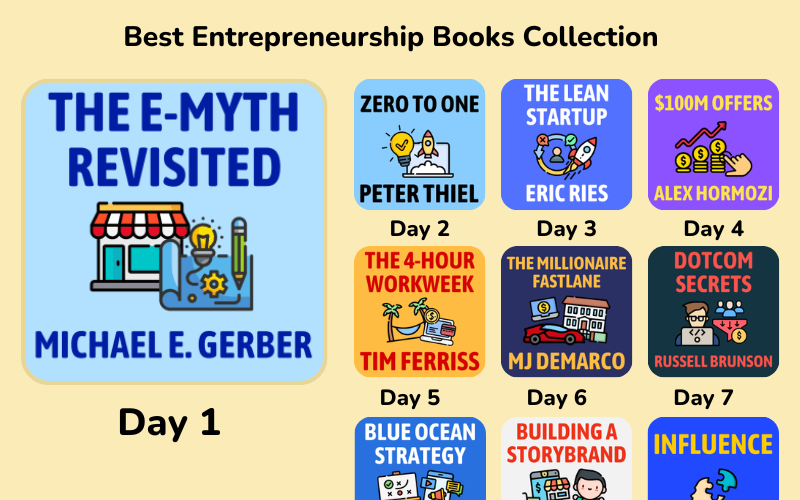

Do you want to build the next billion-dollar tech startup? Then few people are better to learn from than Peter Thiel.

If you’re interested in startups and entrepreneurship, than you’ll hear this book recommended over and over again. For a good reason—Zero to One contains countless fascinating ideas that can change how we view technology, business, and the future.

At Stanford University, the billionaire Peter Thiel gave a series of lectures about entrepreneurship. Students loved the course so much that he decided to turn the lectures into this book.

He talks about:

- How to choose a target market in the beginning,

- The #1 question he asks when hiring someone new,

- And why AVOIDING competition is the key to winning in business.

Curious? Then let’s go!

Who is Peter Thiel?

Peter Thiel (official site) is an entrepreneur and investor. He has a net worth between 4 and 7 billion dollars, depending where you look.

- In 1998, he co-founded PayPal with Elon Musk. Four years later, it was sold to eBay for $1.5 billion. (You can also read our summary of Elon Musk’s biography here!)

- In 2004, he was Facebook’s first outside investor. He bought 10% of the company for half a million dollars. Several years later, he sold most of these shares for over ONE BILLION dollars!

- He invested early in other leading startups like SpaceX, Airbnb, LinkedIn, Yelp and Spotify. His largest recent company is Palantir, which helps large organizations including governments use their data to make decisions.

💡 1. Avoid Competing: Exceptional startups offer something unique that nobody else is doing, often based on a new technology rather than market expansion

Most people see business as a cut-throat competition. Business experts talk about “winning” sales, “outperforming” competitors, and “dominating” the market.

But Peter Thiel says the opposite—that “competition is for losers”! If we want to win, then we need to AVOID competing and instead create (legal) monopolies. That’s how his companies like PayPal and Facebook succeeded.

There are 2 strategies we can use to avoid competition:

- Solve a unique problem. This creates a whole new category of product. For example, Airbnb allowed people to rent extra rooms in their home for the first time. It solved a problem people didn’t even know they had.

- Do something incredibly well. Become so good that nobody can offer a decent replacement. For example, Google has invested so much into their search engine that it’s almost impossible for anyone to make a better solution.

The investor Naval Ravikant offers similar advice. He wrote, “Become the best in the world at what you do. Keep redefining what you do until this is true.” What does that mean? It means we need to keep learning and experimenting until we are doing something that is truly unique. A large part of that is seeking specific knowledge—things that are not really taught in universities because they are at the edge of human knowledge.

For example, I was recently listening to some interviews with the creator of “MrBeast,” the 5th largest Youtube channel in the world with over 100 million subscribers. During his rise to fame, “MrBeast” would obsess all day long about the Youtube algorithm with a small mastermind group of other video creators. He would spend ONE HOUR every single day just brainstorming new ideas for videos. That is a level of specific knowledge and concentrated effort that few people will ever replicate.

Read more in The Almanack of Naval Ravikant

The marketing experts Al Ries and Jack Trout also talk about a similar idea, in their book The 22 Immutable Laws of Marketing. They say when a new startup tries to directly compete against an established market leader, then it almost always fails. A far more effective strategy is if we can create a brand new category for our product.

They wrote, “The basic issue in marketing is creating a category you can be first in. It’s the law of leadership: It’s better to be first than it is to be better. It’s much easier to get into the mind first than to try to convince someone you have a better product than the one that did get there first.”

For example, the first university in the US was… Harvard, the first safety razor was… Gillette and the first imported beer was… Heineken. Can you see the pattern? The first brand to offer a product in each category or market is the one that continues to be number one today. That’s why “it’s better to be first than it is to be better”!

Learn more in our summary of The 22 Immutable Laws of Marketing

The word “monopoly” is usually seen as something negative (and possibly illegal!) But the truth is not so black-and-white. Even the government recognizes value in certain monopolies, by enforcing patents and copyrights. And monopolies provide big profit margins, which is why Silicon Valley companies can treat their employees so well.

On the other hand, companies stuck in fierce competition have extremely thin profit margins. In that situation, it becomes difficult for them to treat either employees or customers well. Thiel’s example of a hyper-competitive business is airlines, they make less than 1% profit from each plane ticket.

The most successful businesses of our time avoid competing. Instead, they create natural monopolies by solving a unique problem or creating a product so amazing nobody else is able to make anything similar.

💥 2. Zero to One: Great companies don’t focus on incremental improvement on what already exists, but on creating a totally new market

Most business plans are based on incremental improvement. That means they take something that’s working and then make it a little better. Maybe they take something that’s working in one place and then spread it all over the place. It’s about going from 1 to 2, 2 to 3, etc.

For example, there were good hamburger restaurants, then the McDonald’s brothers made a better and faster hamburger restaurant. Later there was one McDonald’s, then Ray Kroc spread McDonald’s all over the world. That what it means to go from 1 to 2, 2 to 3, etc.

In the world of startups, popular books like The Lean Startup by Eric Ries teach an approach to business based on that kind of never ending improvement. Entrepreneurs are taught to create a “minimum viable product” to get something into the marketplace as fast as possible. Then they must conduct endless experiments, until it becomes a product customers love.

Peter Thiel argues The Lean Startup teaches a good method for optimizing products that are already existing, but it will never lead to exciting innovation. Imagine if Apple had started with a Motorola phone and optimized it based on customer feedback—they would have never reached the iPhone!

Going from zero to one means jumping from nothing to something, rather than building on what came before. Peter Thiel says truly great businesses always do something new and unique, something that has never been done before.

Right at the beginning of this book, Peter Thiel drops a bomb of wisdom saying “every moment in business happens only once.” What does that mean? If we simply copy what is currently successful, then we’ll fail to catch the next big wave. (By the way, Jeff Bezos is also known for saying “Never chase the hot thing, you have to position yourself and wait for the wave.”)

I’ll give you my own unique example to illustrate… the current social media craze is Tiktok, which is all about vertical short form videos. Tiktok’s growth has been so explosive because they took advantage of multiple key trends. One of them is that people using their phones actually prefer to watch vertical videos, which seemed unwelcome in other places like Youtube. After Tiktok’s recent success, competitors rushed to launch copycat products with Youtube Shorts and Instagram Reels. But the next major social media app will NOT look like Tiktok because “every moment in business happens only once.”

One of the big criticisms you’ll read of Zero to One is that this core idea is flawed. In some online reviews, the critics argue that many of Thiel’s examples are not really “0 to 1” because they improved on previous products:

- Facebook was a better social network than Myspace.

- Google was a better search engine than Yahoo.

- Even Microsoft Windows was preceded by MacOS.

In the biography of Steve Jobs by Walter Isaacson, you can read a very entertaining story about that last example. When Bill Gates first announced that Microsoft would be making a graphical operating system just like MacOS, Steve Jobs was absolutely furious. Jobs invited Gates down to Apple’s offices, then he proceeded to yell at him saying “you’re ripping us off” and calling Microsoft’s new product “a piece of s**t” (Steve Jobs was not known for sugarcoating his opinions!)

The greatest businesses don’t incrementally improve on what is already out there. Instead, they are based on creating a totally new and unique solution that has never existed before. They go from 0 to 1.

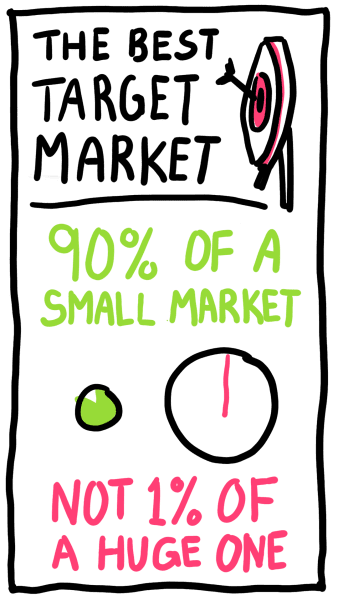

🌱 3. Launch Smaller: Begin with a small, concentrated market that you can dominate and scale up from there

Many startup founders begin with a huge market, like making cars. They wrongly believe that if they can capture even 1% of that market, they will have a billion-dollar company.

But Peter Thiel says that is wrong because large markets are not full of opportunity, but profit-killing competition.

The best startup approach, according to Thiel, is to begin with a small niche market. Find a small group of people not being served, then build a unique solution for them. That’s how you capture a monopoly position.

Many of the most successful companies started small:

- Tesla began with an electric sports car named the Roadster that cost six figures. Only later did they expand into progressively more affordable cars.

- Facebook began as a social network exclusively for Harvard students. Only later did they expand to other universities, then high schools, then everyone. With this strategy, they toppled the dominant Myspace.

- PayPal began with serving PowerSellers on eBay. Their strategy was first getting the most active eBay sellers using their payment service. Then all of the more casual eBay users followed.

I want to add one more fantastic example: Jeff Bezos decided to launch Amazon as a website that sold only books. Over years, they continually expanded to selling music CDs and movie DVDs, then electronics, toys and jewellery. Now, of course, they sell everything.

But that strategy was not an accident. From the first day, Jeff Bezos had the vision of creating an “Everything Store” that would compete against giants like Walmart. He believed that it would be much easier to get a foothold in the market by first mastering one category of products, like books.

Trying to win 1% of a huge market usually fails. Instead, we should begin a new business by targeting a very small group of people that is not being served. Offer something totally unique they will love. Then progressively expand.

👑 4. Capture a Monopoly: Companies become unbeatable through four pathways—proprietary technology, network effects, economies of scale, or branding

So, how exactly do most of today’s leading companies really go “from zero to one.” In other words, how were monopolies actually created by Apple, Google, Amazon, etc?

There are essentially 4 paths to creating a legal monopoly:

- Proprietary technology. Innovation that makes it almost impossible for others to copy your product. This can’t be a small improvement, your product must be at least 10 times better than what came before. For example, Tesla’s engineering is so good their batteries are used by other car companies.

- Network effects. If your product becomes more valuable as more people use it, then it’s possible to build a powerful monopoly. For example, people say Twitter would have been really easy to copy, but the value of Twitter is not the software, it’s that everybody you want to follow is already using Twitter. The same network effect happens with eBay, Airbnb, Youtube, etc.

- Economies of scale. As a company gets larger, they can manufacture products more cheaply than small competitors. So when a large company has been extremely well optimized into a well-oiled machine, they have a strong protection against new competition. A good example are Amazon’s warehouses, which are extraordinarily efficient by relying on cutting edge automation.

- Branding. Only your company can use your brand name, of course. This is a big reason for Apple’s success. Most people trust that when they buy an Apple product, they won’t be disappointed. So it becomes easy to buy the latest Apple gadget, rather than spending lots of time researching all the alternatives.

The story of Nike (the shoe company) provides another great example of the power of branding. When Phil Knight started his company, it was actually called Blue Ribbon Sports and they were the American distributors of Japanese Tiger Shoes. They worked hard to make Tiger shoes popular all over America.

But one day, Tiger Shoes suddenly decided to terminate their contract. Suddenly Phil Knight had lots of shoe stores, employees, and expenses… but no shoes to sell! That was the day he learned the power of controlling your brand. They rushed to launch their own brand of shoes called Nike, and the rest is history.

Companies create unbreakable monopolies in 4 ways: proprietary technology that is 10 times better, network effects from a popular product, economies of scale to offer more value, a brand that is trustworthy or desirable.

🔍 5. Find and Leverage Secrets: The greatest businesses are built on truths that most people have not realized or capitalized on

In Zero to One, Peter Thiel says the most important question he usually asks in a job interview is:

“What important truth do very few people agree with you on?”

This question is surprisingly difficult because any good answer should be unpopular. To think opposite to most people requires intelligence. To express an opinion others will disagree with requires courage. That’s why it’s such a great interview question.

In psychology books like Influence by Robert Cialdini, you can learn about how our brains are actually wired to fit in with the herd. It’s a principle he calls “social proof” and it means we tend to look towards others to determine what is true.

For example, when choosing a product to buy, we may glance at the Amazon rating and the number of reviews. It’s a mental shortcut—we simply don’t have time to figure out everything on our own. And in general, “social proof” is very useful. But in some situations, others can use these mental shortcuts to manipulate us. Such as by paying for fake reviews.

Now, Peter Thiel has a strong reputation for being a “contrarian.” He seems to enjoy going against common opinion when it comes to building startups, higher education, and even Donald Trump. (He supported Trump for President in 2016, despite being a gay man in California.) This book offers a real inside look to why Thiel loves contrary opinions—because they often allow us to see the future.

All great business innovations were once “secrets” to the majority of people. They were first laughed at, dismissed, or ignored.

For example, who would have expected Airbnb to succeed? If you took a time machine back to the year 2000, and said your business idea was a website that would invite strangers from the internet to come sleep in your home… people would have called you crazy! Yet the founders of Airbnb recognized a secret that most people didn’t see. There was a hidden market of people who WOULD be willing to rent their extra bedroom to others.

According to the classic success book Think and Grow Rich, the biggest thing stopping most people from becoming wealthy is a fear of criticism. Napoleon Hill tells the story of Guglielmo Marconi, the inventor of the radio. When he told others that he had discovered how to send messages through the air without any wires, his “friends” brought him to a psychiatric hospital! That’s the risk that comes with finding secrets!

Thiel often asks, “What important truth do very few people agree with you on?” Looking for ideas which are contrary to popular opinion yet true (aka “secrets”) can lead us to valuable business opportunities. Secrets can be a window into the future.

💼 6. Put Selling First: Sales matter as much as product—every business must quickly build at least one effective marketing channel

Every startup must find a profitable channel of gaining customers. In some ways, Thiel says this is even more important than the product. He doesn’t believe at all in the idea “if you build a great product, people will come automatically.”

How do we find a good sales and marketing channel for our business? There’s no single answer. Some businesses may use social media ads, others may need to train a sales team.

The most important thing is that you track your metrics, because you MUST make more money from each customer than you spend to get them. In business lingo, that means your Customer Lifetime Value must be higher than your Cost Per Acquisition.

PayPal gained hundreds of thousands of users fast because they built a very unique promotion channel—they basically turned ALL of their customers into commissioned salespeople! That’s right. If someone recommended PayPal to a friend, and the friend signed up, then both of them would receive $10 each! This strategy was obviously expensive, but it gave PayPal a critical head start over all the other online payment startups.

If you want to grow a business to the next level, one of the best-reviewed recent books on that topic is Traction by Gino Wickman. It explains how any business can gain more… well, traction by focusing on 6 key tools.

The most interesting one of those tools is called a “Data Dashboard.” Any entrepreneur should have one place (like a spreadsheet) where you can instantly see all important metrics like the number of leads, sales, profit, etc. It provides an instant picture of the overall health of your business.

Taking the idea further, that book also recommends each employee have ONE NUMBER they are personally accountable for. Something that is very specific and measurable related to their performance. Coincidentally, Peter Thiel also says “the best thing” he did managing PayPal was to give every person ONE UNIQUE THING they were responsible for.

A great product isn’t enough, you MUST quickly find a profitable channel of gaining new customers. Customer Lifetime Value must be higher than Cost Per Acquisition. PayPal grew fast with a referral strategy—they paid users $10 directly to invite their friends.

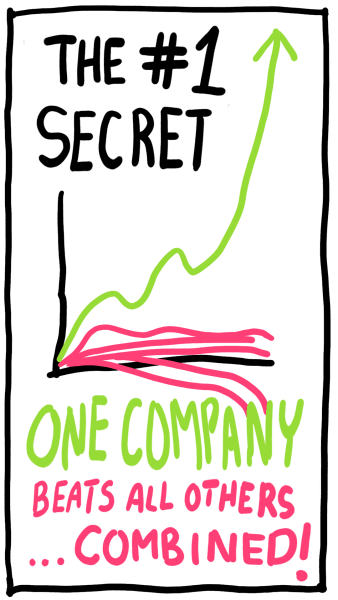

📈 7. Think Exponentially: You don’t need to be right a lot—often only ONE home run idea is needed to become a billionaire

Usually, we think of success as being linear. Maybe that’s because most of us get paid in a linear way. What I mean is that we get a steady paycheck, usually every two weeks, with gradual raises.

However, this is actually a very artificial situation. In the less structured world of startup investing, the returns are extremely non-linear.

Peter Thiel calls it “the biggest secret in venture capital”—the returns from the ONE BEST INVESTMENT that someone made very often outweigh the returns from ALL their other investments… combined. For Thiel’s fund, that exceptional investment was Facebook.

This is related to the 80/20 Rule, which state that 80% of results in anything tend to come from 20% of inputs. In the case of startup investing, it may look more like the 99/1 Rule. A venture capitalist will often make dozens of investments in startups that fail or only make a few million dollars. But they only need to make ONE early investment in a Facebook or Uber to become a billionaire.

There are 2 investing takeaways from this:

- Make sure each startup idea have the potential of hitting it big. A startup idea that can “only” make millions of dollars is not good enough to outweigh the risk for a venture capital investor. They must look for those few startup ideas that have almost unlimited upside, because the potential customer will be almost everybody. (As in Facebook or Uber.)

- Make a limited number of careful investments. Typically, investors talk about a widely diversified portfolio. This strategy is different. Thiel isn’t trying to “avoid putting all his eggs in one basket” but “putting all his eggs in a few carefully chosen baskets” with the understanding that most of the startups will fail no matter what.

One of the most fascinating books that I’ve ever read is The Black Swan by Nassim Taleb. He explain that the future is much less predictable than we believe because history is filled with extreme events called “Black Swans.” Black Swans were unexpected but changed the world, like the 9/11 terrorist attacks or the rise of the internet.

In our personal lives, we often fail to see the powerful role of randomness in success and failure. However, this is not a reason to throw up our hands and say “it’s all luck.” Instead, Nassim Taleb says that investors and entrepreneurs must follow a strategy of “aggressive trial and error” to become successful.

Taleb himself puts 90% of his money into a very safe investment (US Treasury Bills) and the other 10% is dedicated to highly experimental bets. (Just like Peter Thiel’s investing strategy of aiming for highly unlikely home runs.) In this way, they invite a positive Black Swan to enter their lives.

In most startup investing funds, almost ALL their returns come from ONE exceptionally successful company like Facebook. That means venture capital investors must always invest in companies that have almost unlimited upside potential, to become the next Facebook, Uber, or Google.

- Find a list of 100 potential customers to contact. For your current business or next startup idea, remember to begin with targeting “a small group of particular people.” And ideally, your target market has places they hang out in, like Facebook groups, online forums, or podcast communities. The best way to understand their exact needs for a product or service is by studying your target customers and ideally talking with them directly.

- Answer Thiel’s question, “What important truth do very few people agree with you on?” If you’re afraid to share your view with others, then you are probably on the right track! For example, have you ever heard another business book say “competition is for losers”? Most of the great innovations were in the beginning misunderstood or ridiculed by the majority of people.

- Ask: How does the 80/20 rule apply to my business or life? Even if we’re not risk-taking startup investors, we can still apply Peter Thiel’s strategy of seeking exponential returns to our lives. When it comes to success, the most important thing to understand is that WHAT we do is far more important than how productive we are. For example, in Tim Ferris’s book The 4-Hour Workweek, he explains how he DOUBLED his income by getting rid of 80% of his customers, because that allowed him better serve the most profitable 20%.

small, gradual enhancements to existing products, services, or processes

Good insight for start-up

Nice